When Bitcoin initially surfaced in 2009, it seemed out of this world—a digital currency that couldn’t be touched but could be bought, sold, and increased in value. Few individuals understood it, but those who did experienced life-changing effects.

Today, a similar phenomenon is occurring in real estate, but the assets are not merely virtual. They are built of bricks and mortar. Imagine a Nairobi apartment worth KES 5 million divided into 100,000 digital tokens, each worth KES 50. Suddenly, anyone, not just institutional investors, can hold a share. That’s the promise of real estate tokenization, and it’s making property ownership more accessible than ever before.

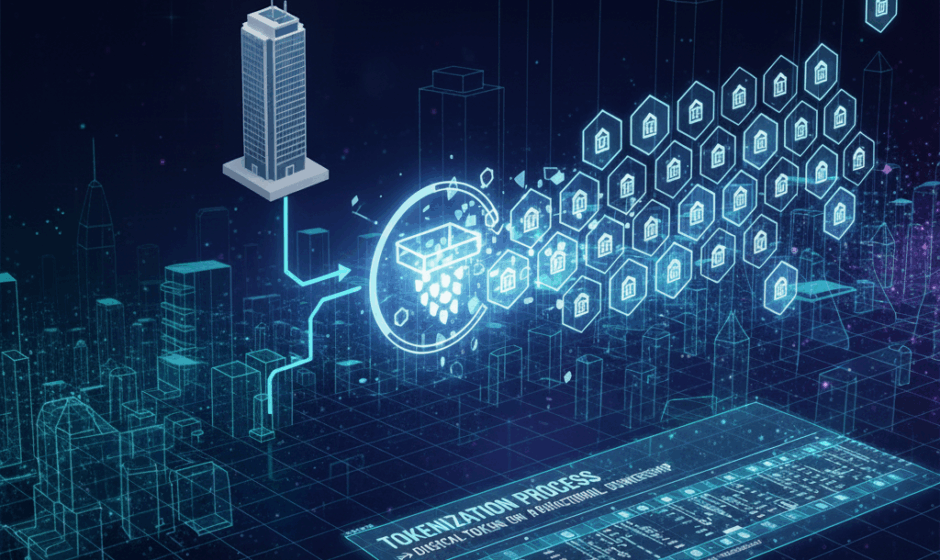

Tokenization is the process of breaking down physical assets (land, buildings) into digital tokens on a blockchain. Each token represents a fractional ownership share. These tokens are recorded on a blockchain, the same technology behind digital currencies like Bitcoin, but with far broader uses. This process offers numerous benefits, including enhanced liquidity, transparency and efficiency in transactions.

In Kenya, one company is bringing this concept to life for everyday people: Hodhi.

The Founder’s A-Ha Moment

Mao Mukuria, Hodhi’s co-founder, began his journey with a career change—and cash in hand.

He had just quit his job and was, in his own words, “very liquid at the moment.” After some research, he discovered that real estate is an appealing, tangible investment. The cushion money he felt was substantial was, in fact, only enough for a studio apartment.

“I ran the numbers,” he recalls. “A studio would give me about a 6% annual yield—but I’d have to stay very liquid or have constant access to credit to make it worthwhile.”

He began looking at other options and discovered government bonds. At the time, 10-year bonds were yielding 18% annually, and after maturity, inflation would give him roughly 60% of his initial investment returned in real value.

“That was my aah moment,” he says. “Real estate had the upside of appreciation but came with high capital costs and modest yields. Government bonds were secure, affordable, and had no depreciation risk. The question became: How do we invest in an apartment, use the rent to buy government securities, and combine the benefits of both?”

That question led to AKRE—Affordable Key to Real Estate, Hodhi’s flagship product. The name is a play on “Hodi,” Swahili for “may I come in,” symbolizing an invitation into property investment for all.

To execute the vision, Mukuria approached Graeme Reid, a real estate expert with over 30 years of experience who has worked with the Johannesburg Development Agency, Two Rivers, Tatu City, and Tilisi, giving him the label “father of mixed-use, mixed-income developments in Kenya.”

The two designed AKRE to combine the asset appreciation of property with the secure, compounding yields of government bonds.

“Mortgages have their place,” Mao says, “but the idea of paying one off over 20 years is daunting—especially after COVID showed us how quickly circumstances can change. With AKRE, you can start for 50 shillings, grow over time, and still have access to credit along the way.”

The First Experiment

“Our first stop,” Mao recalls, “was to put money aside and invest in a rental property. We asked ourselves: can we buy an apartment, rent it out, and then put the rent into government bonds?”

The first year, the AKRE value increased by 10%. Compounding caused it to increase by 20% the next year. “The longer it stays in, the stronger the compounding effect. That’s when I knew we were onto something.”

Now, Hodhi is in the final stages of registration with the Capital Markets Authority (CMA) — a milestone Mao expects to achieve soon. The process had experienced some delays due to new legislation that introduced overlapping mandates between the CMA and the newly established regulator, NIFCA. However, with recent engagements between Hodhi and NIFCA, the registration process is now nearing completion.

“The goal is to have layers of security for people investing in AKRE,” he says. “We’ve spoken to multiple developers and property owners. We have a pipeline of about 3,500 units across various developments that we’ll eventually ‘AKRE-rize.’ One project has 1,500 units, another 60, others in between.”

Turning Rent into Savings

The main breakthrough in describing AKRE comes from redefining rent.

“You’ve probably been paying rent for five years,” Mao says. “What if you could buy acres in the building you live in, so your rental payments are literally going towards your investment? It’s like turning rent into savings.”

Think of an AKRE as a share — one that will eventually be traded on the Nairobi Securities Exchange, just like any other stock. But unlike a volatile share price, the value of an AKRE is designed to be stable and steadily increasing.

The growth comes from three combined forces:

- Asset appreciation.

- Reinvestment of rental income.

- Returns from government securities.

One of the most powerful aspects of Hodhi’s model is the shift in mindset it enables. Traditionally, rent is seen as money lost forever. AKRE flips that.

Take Aisha, a 28-year-old marketing executive from Nairobi. She’s been renting for five years, paying approximately KES 30,000 every month. Under Hodhi’s approach, she may purchase AKREs in the same building where she lives, directing her rent towards increasing her ownership interest. Over a decade, between asset appreciation and compounded bond returns, she could convert hundreds of thousands of shillings of “lost” rent into a meaningful asset base.

“It’s like turning an expense into a savings plan you can touch,” Mao says.

How AKRE Works

The process is simple. Investors log in to Hodhi’s platform, set up or link their Central Depository System (CDS) account — the same account used for trading shares and government bonds — and browse available properties. Then select a property, choose the number of AKREs you want, and make a payment.

Over time, as the property appreciates and rental income compounds through government securities, the value of the AKRE grows. Investors can hold, sell for a profit, or use their AKREs as collateral for affordable credit.

“One of the coolest parts,” Mao says, “is you can invest in the building you live in. Your rent turns into savings.”

Credit, Without the Trap

One of the key advantages of AKRE is its credit potential. “In Kenya, if you’re in a SACCO, you have to keep paying monthly to maintain your credit access. Miss a payment, and you lose that privilege. With AKRE, you buy once, and the asset’s appreciation allows you to borrow against it repeatedly — without ongoing fees.”

He shares a generational example, “Your grandfather buys a worthless piece of land. By the time your father inherits it, it’s worth millions, so he uses the title to get an affordable loan. By the time it’s yours, it’s worth hundreds of millions. That’s the power of a growing, appreciating asset. We just built a way to make that happen without starting with millions in the first place.”

Traction and Market Readiness: 104,300 AKREs Booked

In just months since launching, Hodhi has seen 104,300 AKREs booked—a strong signal that the market is ready. The data reveals a diverse investor base: first-time savers putting in KES 500 alongside seasoned investors diversifying beyond traditional stocks.

“This isn’t just early adopters or crypto enthusiasts,” Mao notes. “It’s teachers, boda boda riders, mid-level professionals—all seeing that they can participate in an asset class that was previously out of reach.”

The speed of uptake reflects a broader trend in Africa. When financial products are made affordable, transparent, and mobile-friendly, adoption is almost immediate. We’ve seen this with mobile banking, savings apps, and now real estate.

The Rise of Tokenized Real Estate

The global tokenized real estate market is set to experience massive growth, with Deloitte forecasting a jump from under $300 billion in 2024 to $4 trillion by 2035. This expansion is fueled by blockchain technology, which enables fractional ownership of properties. Tokenization promises to make real estate investment more accessible by tackling high administrative costs and operational inefficiencies.

By 2027, the World Economic Forum predicts that digital ledgers could store up to 10% of global GDP, with real estate and securities as key assets. Many nations are now moving from pilot programs to large-scale initiatives, and we will explore some of the leaders and key projects in this space.

Dubai’s real estate market saw a 22% jump in property transactions in Q1 2025, totalling AED 87.5 billion (about $23.8 billion), with analysts crediting the surge in tokenized projects. Saudi Arabia is following suit—droppRWA and RAFAL Real Estate recently launched the kingdom’s first tokenized deal, allowing citizens to co-own luxury properties from just 1 riyal (~$0.27).

In the U.S., Bergen County, New Jersey, is digitizing and tokenizing over 370,000 property records—$240 billion worth—through blockchain startup Balcony, marking America’s first state-backed initiative. Meanwhile, in Japan, regulatory support has put it ahead in Asia; in 2025, investment firm GATES began digitizing assets worth more than $200 billion, setting the stage for one of the world’s largest tokenization ecosystems.

Africa’s real estate market is projected to reach $21.92 trillion by 2029, making it a fertile ground for tokenization. Nigeria and South Africa pioneered pilots, with Nigeria digitizing property titles and South Africa’s Realsmart focusing on fractional premium real estate.

Kenya has quickly become East Africa’s most active hub. The country’s regulatory sandbox and national digital land registry, Ardhisasa, are laying the groundwork for platforms like Hodhi. Through its AKREs (Affordable Key to Real Estate), Hodhi is positioning itself as a first mover in offering secure, fractional property investment to a wider pool of investors.

“But our model is different,” Mao says. “We’re not just giving you a fraction of rental income. We’re reinvesting that rental income into government securities, which compounds your returns and can be used for affordable credit. That’s unique.”

Due Diligence & Security Layers

Hodhi’s model rests on trust — and Mao knows that means airtight due diligence.

“First, we verify every property,” he says. “Clean title deed, credible developer, solid development history. Then, we put the property into a Special Purpose Vehicle (SPV), which legally owns it on behalf of the AKRE holders. The title deed is held by a trustee — so no one person can run off with it.”

On the returns side, government securities offer stability. Governments rarely default because the consequences are catastrophic.

Hodhi’s Approach to Risk Management.

Every investment has risks, but Mao outlines how Hodhi addresses them:

1. Asset Depreciation:

- Partner with top property managers to maintain buildings.

- Target high-demand areas where rental demand remains strong.

2. Rental Risk:

- Focus on affordable rental units in strategic urban zones with amenities.

3. Government Security Risk:

- Government bonds are among the safest investments globally — default is rare because it would cripple a country’s ability to raise capital.

4. Regulatory Risk:

- Operate fully under CMA oversight with transparent governance structures.

How Tokenization Addresses Africa’s Real Estate Issues and Why This Is the Right Time

Africa’s real estate market is paradoxical: it’s booming, yet inaccessible. Cities like Nairobi, Lagos, and Accra are seeing property prices soar beyond the reach of most citizens, even as millions remain without adequate housing. Traditional investment paths—full property purchases or mortgages—are capital-intensive, while smaller investors are locked out entirely.

Tokenization flips this script. By breaking down a property into thousands of digital tokens, each representing a fractional share, the barrier to entry drops from millions of shillings to just a few coins in your pocket. It’s a model that mirrors the rise of mobile money—accessible, flexible, and tailored for the everyday African investor.

The timing could not be better. Post-pandemic economic shifts have increased demand for flexible investments, technology adoption has skyrocketed thanks to mobile penetration, and trust in alternative asset classes is growing. “Just like how M-Pesa made financial inclusion possible for millions, tokenization can do the same for real estate,” says Mao. “And in Africa, where demand for property far outpaces supply, being able to start small and grow your stake over time changes everything.”

Mao says, timing is everything. “Historically, quality real estate investment has been for the wealthy. We’re making it accessible at scale — starting at just 50 shillings per AKRE. And Kenya’s urban population is growing fast. The demand for affordable, quality rental housing will only go up.”

He pauses, then adds, “COVID changed everything. Two years of uncertainty showed us the value of security and flexibility. Mortgages tie you down for decades. AKRE gives you freedom.”

How AKRE Differs from REITs

Real Estate Investment Trusts (REITs) and traditional property shares were early attempts at democratizing property investment, but they come with trade-offs.

In a REIT, investors pool funds into a trust that owns a broad portfolio of properties. While this spreads risk, it also means the performance of a single underperforming property can drag down the entire portfolio—something Mao points out with the example of the Fahari I-REIT, which struggled due to a few problematic assets.

AKRE flips that model. “With AKREs, you can choose the exact property you want exposure to—say an apartment block in Kilimani with 95% occupancy—rather than taking on the baggage of an entire portfolio,” Mao explains.

This precision gives investors control, while the reinvestment of rental income into government securities adds a fixed-income layer that REITs simply don’t offer.

Where Tokenization Fits in the Investment World

Tokenization bridges the worlds of real assets and digital finance. It turns physical properties into digital tokens, giving investors the stability of real estate with the flexibility of blockchain. This means fractional ownership, around-the-clock trading(where regulation permits) and faster, more transparent settlements.

Tokenized real estate offers the best of multiple asset classes. It’s generally less volatile than stocks, offers both yield and appreciation, unlike most bonds, and avoids the wild price swings of purely digital cryptocurrencies because it’s backed by a real-world asset.

The concept is already transforming industries beyond property, from renewable energy projects to infrastructure finance, driving efficiency, lowering costs, and increasing transparency. As the market matures, now is the time to explore this technology. For business leaders, the key is to identify specific use cases where tokenization can solve existing challenges and have clear business objectives and a focus on creating real value.

The Vision: Freedom and Opportunity

Looking five, ten, or twenty years ahead, Mao wants Hodhi to be remembered for one thing: freedom.

“I want people to say: Hodhi was there when I needed a quick loan. Hodhi was there when I sold my AKREs for a huge profit. Hodhi turned my rent into savings.”

He smiles, picturing a young investor’s journey: “At 20, you buy your first AKREs. Four years later, your biggest concern is buying a car. Five years after that, your first child. Fifteen years later, you’ll have a down payment for your own home. And through it all, your investment has been growing quietly in the background.”

AKRE’s is a patient, disciplined approach to wealth building that blends the stability of government bonds with the time-tested value of property.

“Most people think they have to choose between safety and growth,” Mao says. “We just decided — why not both?”